Renters Insurance in and around Waunakee

Waunakee renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Waunakee

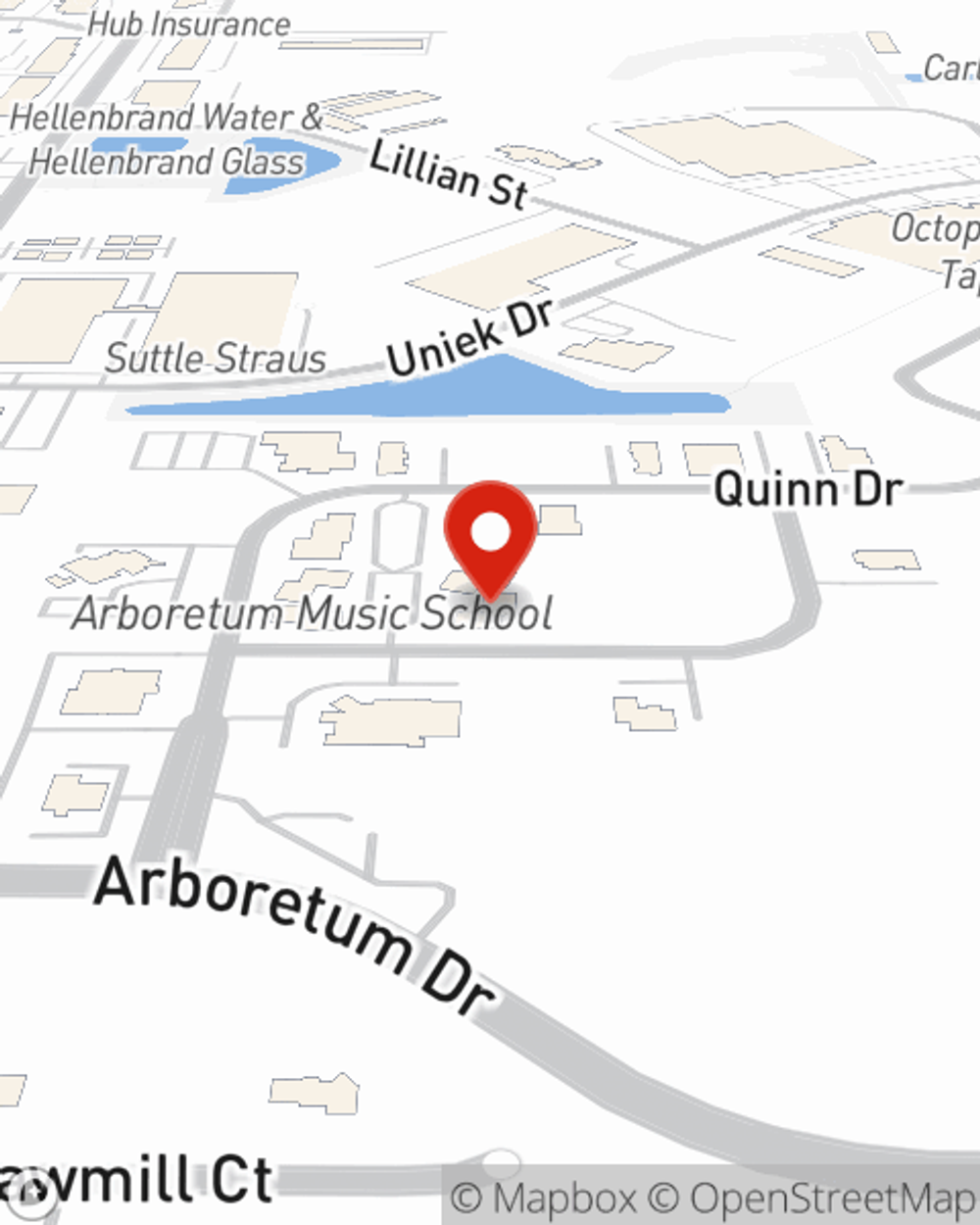

- Arboretum Village

- Kilkenny Farms

- Savannah Village

- Westbridge

- Southbridge

- Windsor

- Westport

- Madison

- Sun Prairie

- DeForest

- Middleton

- Lodi

- Verona

- Fitchburg

- Dane County

- Sauk City

- Baraboo

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - number of bathrooms, number of bedrooms, utilities, condo or house - getting the right insurance can be vital in the event of the unanticipated.

Waunakee renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

There's No Place Like Home

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside the place you call home with coverage. In the event of smoke damage or abrupt water damage, some of your belongings may have damage. Without insurance to cover your possessions, you may struggle to replace the things you lost. It's scary to think that in one moment, everything you own could be lost or destroyed. Despite all that could go wrong, State Farm Agent John Jensen is ready to help.John Jensen can help offer options for the level of coverage you have in mind. You can even include protection for valuables if you take them outside your home. For example, if your personal property is damaged by a fire, your car is stolen with your computer inside it or your bicycle is stolen from work, Agent John Jensen can be there to help you submit your claim and help your life go right again.

Renters of Waunakee, State Farm is here for all your insurance needs. Contact agent John Jensen's office to learn more about choosing the right coverage options for your rented townhome.

Have More Questions About Renters Insurance?

Call John at (608) 850-9640 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

John Jensen

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.